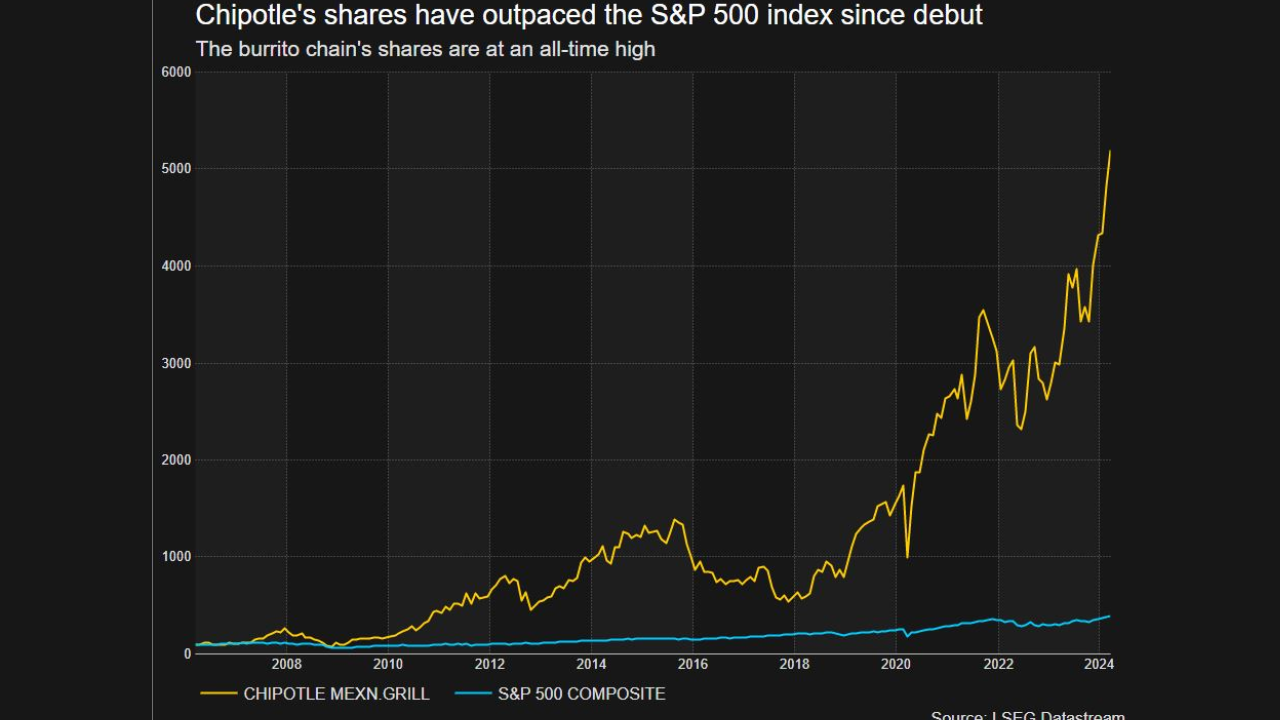

Reuters, March 20 – As the firm attempts to lower the price of its shares for potential investors, Chipotle Mexican Grill’s (CMG.N) opens new tab stock broke through the $3,000 barrier for the first time ever. On Wednesday, the stock increased by as much as 8% following the board approval of a 50-for-1 stock split.

Due in large part to the company’s comparatively affluent clientele’s robust demand for burritos and rice bowls, shares of the California-based business have surged to all-time highs during the last year.Through a stock split, individual investors can purchase shares at a reduced price without compromising the company’s worth.

After the split, the company’s shares would trade at around $56, based on Tuesday’s closing price of $2,797.56. Approximately 27.4 million shares of Chipotle are outstanding.

The company’s shareholders will get an additional 49 shares for each share held if the split is approved at the next annual meeting on June 6.

Chipotle’s value per share was the fourth highest on the S&P 500 index as of Tuesday’s close. It was worth $76.71 billion on the market.

The first split in the company’s thirty years “will make our stock more accessible to employees as well as a broader range of investors,” Chipotle’s Chief Financial and Administrative Officer Jack Hartung stated on Tuesday.

According to Thomas Hayes, head of hedge fund Great Hill Capital, “they’re also trying to do what Walmart has done in the sense that they want to give employees more economic ownership.”

Walmart (WMT.N), a retail behemoth, announced a 3-for-1 share split on February 26. This move made the shares more accessible to its staff, who can choose to purchase the stock through payroll deductions.

“With the recent surge in the share price, the liquidity of Chipotle’s shares should be improved by the company’s stock split. If not, the business’s economics are still quite strong,” Northcoast Research analyst Jim Sanderson stated.

In January 2006, the fast-casual Mexican restaurant went public at a price of $22 per share.

Its price-to-earnings multiple (P/E), which is a standard measure used to value equities, is 49.72. This is higher than the P/E ratios of its industry rivals, which are 20.89 for Starbucks (SBUX.O) and 22.24 for McDonald’s (MCD.N).