Invincible NVIDIA: Chipmaker’s market capitalization rises $277 billion in a single day as equities soar.

The entire market capitalizations of established industry titans Bank of America ($265 billion) and Coca-Cola ($263 billion) are less than NVIDIA’s one-day gain. Only 26 out of the 500 S&P 500 businesses, including NVIDIA, have market capitalization greater than $273 billion overall.

In addition to seizing a sizable portion of the market and profitably riding the early phases of the artificial intelligence explosion, chip designer NVIDIA has also cemented its place in stock market history.

The $1.9 trillion AI giant surged to a record-high stock price and increased its market capitalization by nearly $277 billion in a single day, surpassing a record set by Meta a few weeks prior with a $205 billion gain.

In comparison, the one-day rise of NVIDIA surpasses the combined market capitalizations of established industry titans Coca-Cola ($263 billion) and Bank of America ($265 billion). Only 26 out of the 500 S&P 500 businesses, including NVIDIA, have market capitalization greater than $273 billion.

NVIDIA clearly dominates the AI chip business, controlling more than 70% of the market, and startups are lining up to spend large sums of money in its hardware systems. The financial world is just as intrigued, as seen by the startling 15% rise in NVIDIA stock when the business exceeded high earnings projections in the previous quarter. Its stock value has tripled in the last year alone, and this boom has pushed its market cap beyond $1.9 trillion.

The Strategic Vision of NVIDIA:

The reason for NVIDIA’s rise is its precocious strategic investments in AI. Its chip designs are so far ahead of the competition that analysts wonder if anybody else will ever be able to match them. NVIDIA created a new standard for the industry by smoothly fusing hardware with AI-focused software, in contrast to rivals like Arm Holdings and Intel.

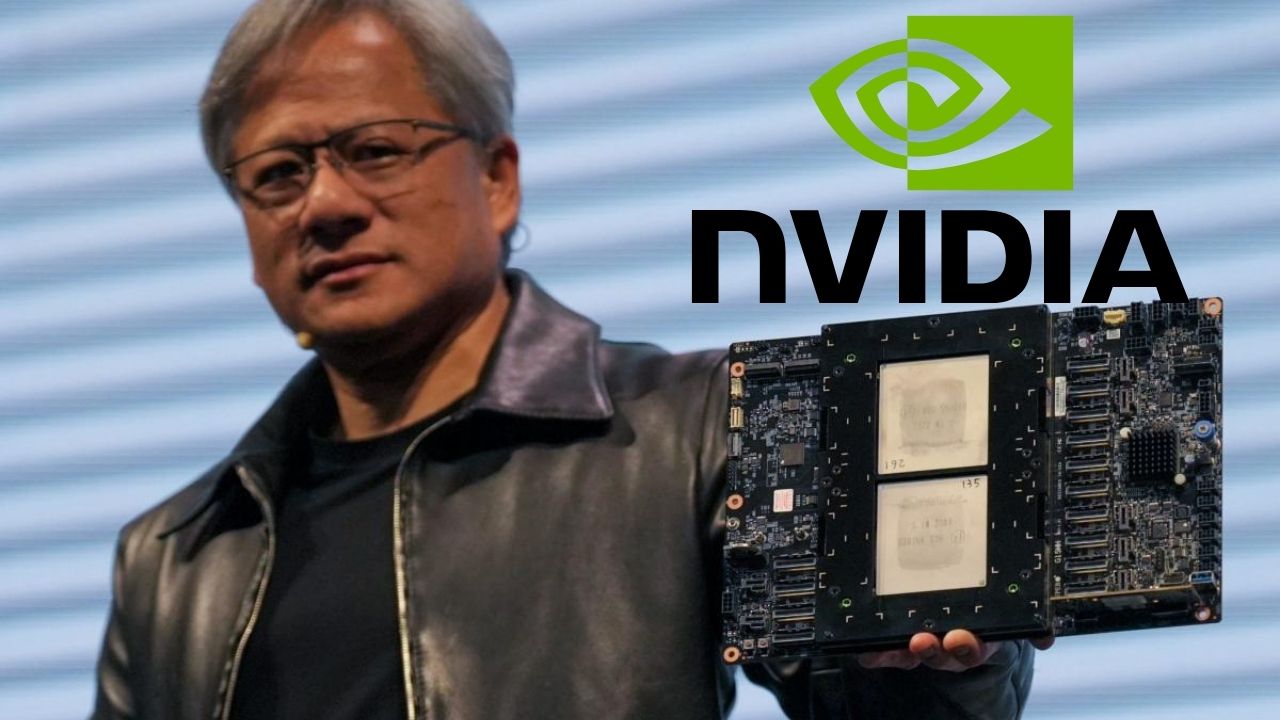

Jensen Huang, the CEO and co-founder of NVIDIA, highlighted the company’s early understanding of the AI environment in a speech at the DealBook event hosted by the New York Times. Huang asserts that NVIDIA “got it” before everyone else, demonstrating their unmatched comprehension of AI’s potential for revolutionary change.

NVIDIA’s success can be attributed to their concentration on software in addition to hardware. Rivals focused only on chip architecture, whereas NVIDIA actively pushed its CUDA programming interface, giving programmers the best foundation for creating AI applications.

The Significance of Hardware:

AI’s insatiable thirst for processing power highlights how important hardware is. NVIDIA is in a good position given the growing demand for AI chips in the market because to its processors’ ability to handle enormous volumes of data. During a financial call, Huang announced the transition from general-purpose to accelerated computing, praising it as a fledgling sector unto itself.

Innovative Artificial Intelligence Hardware

Long before the AI market took off in the middle of the 2010s, NVIDIA started making hardware for the technology. NVIDIA discovered the ideal match for AI creation and training by utilizing its cutting-edge GPUs, which were first created for gaming applications. As early as 2012, the company’s chips powered ground-breaking initiatives like AlexNet, providing NVIDIA an unmatched early mover advantage.

After that point, NVIDIA has made significant investments in its AI hardware division, showcasing devices like the $250,000 Hopper GPU. The firm has reached previously unheard-of heights in the AI hardware industry because to its strategic positioning and careful execution.